FINTRUX — MAKING UNSECURED LOANS HIGHLY SECURE

An unsecured loan is a loan that is not protected or secured by any asset. In this case the lender is taking a lot more risk and would likely charge a higher interest rate. The riskier the loan, the more expensive it will be.

We make borrowing and lending a no-brainer for both borrowers and investors.

Whats Is FINTRUX?

FintruX is the world’s first blockbuster, based on online market and automated administration platform for financing By connecting borrowers and investors, enabling them to customize and generate each contract in real time.

Our Vision and Mission

Our technology supports this innovative marketplace and administration model to efficiently connect and process the global supply and demand of capital.

Our platform also removes the need for physical infrastructure and brings out convenience and total automation, increasing efficiency, reducing manual processes and improving the overall borrowing and lending experience.

What Makes Us Different?

We use cascading levels of credit enhancement to improve credit worthiness. Through credit enhancement, the lender is provided with reassurance that the borrower will honor the obligation.

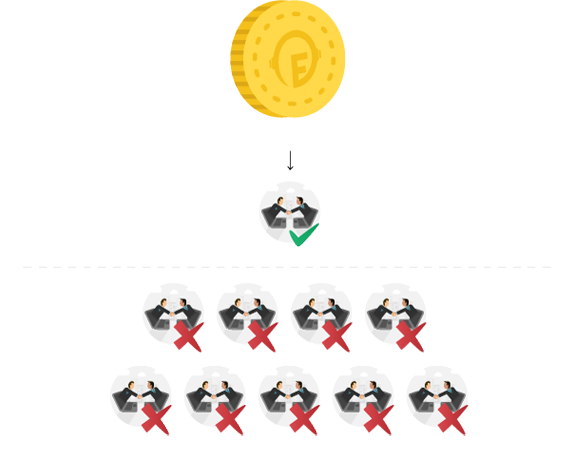

LEVEL 1: Over-Collateralization

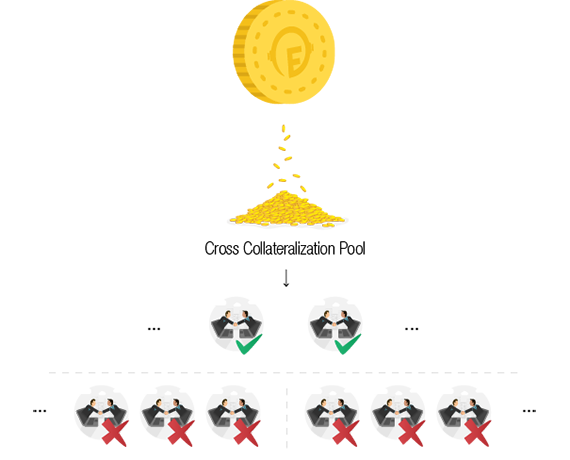

LEVEL 2: Cross-Collateralization

LEVEL 3: Third-Party Guarantors

LEVEL 4: FintruX Collateralization Reserve

Target Metrics

Installments are paid within minutes Activity reports in seconds

The Problem

Most of the financing comes from third parties such as brokers and other intermediaries. This adds to the cost, time and complexity of the process. Furthermore, the administrative process is usually labor intensive. Most Financing contracts are elusive and special instructions such as trade-ups, buyouts, refinances, prepayments, final processing, etc. are mostly done manually on spreadsheets.

Most of the systems used by investors are not fully automated, records can be changed, censored, and subject to the actions of the country’s domicile patriots.

The Financing Industry has yet to adopt or implement new technologies to meet new product demand and increased concerns about data privacy, increased competition and changes in consumer behavior pushing them in this direction.

Financing processes that manage risks, premiums and claims usually involve significant data exchange between multiple parties. Currently, various parties will keep a copy of their own data, and process it separately. This makes it difficult to sync and collaborate through a shared process.

Online financing portals that attempt to bypass intermediaries have failed to address the above issues.

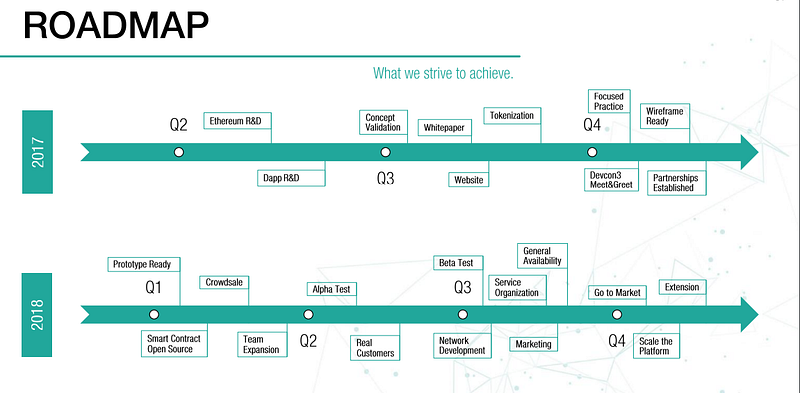

Roadmap

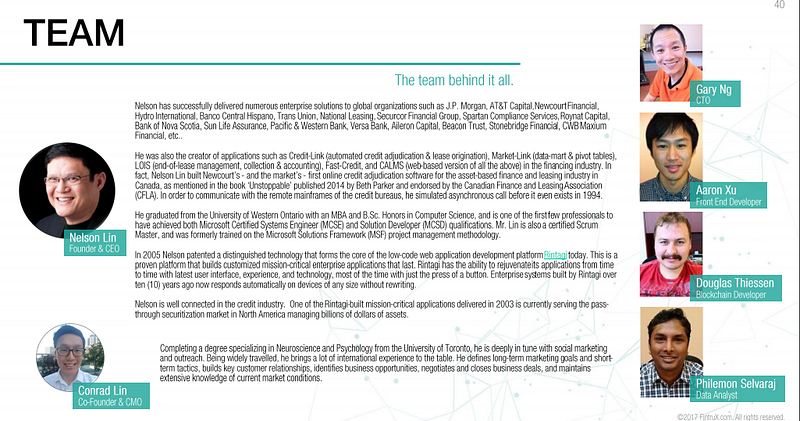

Team

Medium: https://medium.com/@FintruX

Telegram: https://t.me/FintruX

Facebook: https://www.facebook.com/fintrux

Twitter: https://twitter.com/fintrux

Reddit: https://www.reddit.com/r/fintrux

ANN Thread: https://bitcointalk.org/index.php?topic=2286042

Created By: kencingbae

Bitcointalk Profile:https://bitcointalk.org/index.php?action=profile;u=1770976;sa=forumProfile

Tidak ada komentar:

Posting Komentar